Hong Kong as a tax haven

Hong Kong has long been known as a popular tax haven jurisdiction. Compared to other tax friendly jurisdictions, like the BVI or the Cayman Islands, Hong Kong has a highly developed legal, regulatory, and financial framework. For these reasons, many companies choose Hong Kong as their primary offshore jurisdiction to setup a company, where the profits of the company may be considered tax-free.

Hong Kong uses a territorial basis tax system, meaning that Hong Kong will only tax income that was made within Hong Kong. Income that was made outside Hong Kong will be tax exempt if an offshore profits claim is made.

What is an Offshore Profits Claim?

To attract multinational corporations to setup companies, Hong Kong has implemented the profits tax exemption to make sure corporations are only taxed on income sourced in Hong Kong. The profits tax offshore claim allows companies filing their profits tax to claim a portion of or their entire income as offshore. If the claim is successful, the income will not be subject to Hong Kong profits tax.

However, there are numerous factors that need to be considered when determining whether the company and the income qualifies as offshore income. Different industries have different rules used to determine whether their income is offshore.

Factors used to Determine if a Company’s Profits are Offshore

The Hong Kong tax authorities use a basic 3 condition test to determine whether a company should be paying taxes in Hong Kong. The 3 conditions, also known as the basic test for liability to profits tax in Hong Kong, are:

- The person must carry on a trade, profession, or business in Hong Kong.

- The profits to be charged must be from such trade, profession or business carried on by the person in Hong Kong.

- The profits must be profits arising in or derived from Hong Kong.

Condition 3 of the basic test is the main deciding principle that determines whether a company can make an offshore claim on their income. The Hong Kong tax authorities have issued an official tax note “Departmental Interpretation And Practice Note 21” on how they determine whether a company’s profits are offshore or not. The rules differ depending on the business nature, activity, and industry of the company, as illustrated in the following table.

| Business Activity | Department’s View on Source of Profits |

| Trading Profits | The source of trading profits is determined by where the profit-producing activities are carried out. This is a question of fact in each case. The IRD will consider factors such as, where contracts are negotiated, where the employees servicing the contract are located, and where the management of the company carry out their work. |

| Service income | The source of income made from providing services is the location of where the services where provided. |

| Re-invoicing Centre | Profits from a re-invoicing operation will be sourced where the essential profit-producing activities take place, such as the negotiation, conclusion and execution of the contracts. |

| Buying Office | Profits will be sourced where the buying activities (negotiation, conclusion and execution of contracts) take place, rather than where the goods are shipped to or resold. |

| Manufacturing Profits | Where the manufacturing process takes place is the key factor in determining the source of profits, rather than the location of sale, shipment or other ancillary activities. |

| Contract Processing | Profits will be sourced where the contract processing activities are carried out, rather than where the raw materials are supplied from or where the processed goods are delivered to. |

| Import Processing | Similarly, the source of profits is where the processing activities take place, not where the raw materials are obtained or the processed goods are sold. |

| Group Service Companies | The source of profits will depend on where the service activities that generate the profits are performed. |

| Agency fee | The source of agency profits depends on where the agent’s activities that generate the commission take place. |

The Departmental Interpretation And Practice Note 21 emphasizes that the determination of source is a matter of fact in each case, and there is no simple legal test that can be universally applied. The IRD will use the totality of the profit-producing activities and where they are carried out to make their judgement on whether the company’s income can be considered offshore.

Read More: A Guide to Hong Kong’s Corporate Taxes

The Process of filing for an offshore claim

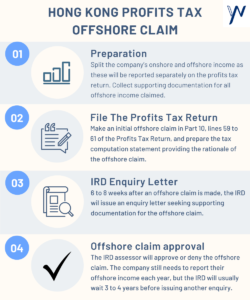

How does a company file a profits tax offshore claim? A successful offshore claim will mean that the profits of your company are tax exempt. How long the offshore claim process takes differs from claim to claim, but generally follows the same steps:

- Split your company’s income from onshore and offshore, as the company will need to reports its onshore and offshore income separately. Prepare all documentation for the income considered offshore, as this information may need to be submitted as supporting documentation when the IRD makes and enquiry.

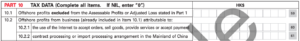

- The initial offshore claim is made when filing the yearly profits tax return. While filling out the profits tax return, in Part 10, lines 59 to 61, enter the amount of income which the company will be claiming as offshore. If all of the company’s operations take place outside of Hong Kong, then the entire income of the company would be entered here.

Besides entering the amount of income claimed offshore in Part 10 of the profits tax return, the tax computation that accompanies the profits tax return should also state clearly the amount of income the company will claim as offshore, and the supporting rationale of why that income should be considered offshore.

Part 10 of the Profits Tax Return

- 6 to 8 weeks after the company has made an offshore claim, the IRD will issue an enquiry letter to ask the company for supporting rationale and documentation. During this stage of the offshore claim process, the Hong Kong IRD may issue multiple follow up enquiries depending on the clarify of the company’s responses, completeness of supporting documentation, and complexity of the offshore claim.

- After the IRD is satisfied that all information regarding the offshore income has been gathered, the IRD assessor will decide whether the offshore claim has been approved or denied. If the offshore claim has been approved, the claim will usually have a validity period of 3 years. This means that the IRD will likely not issue any enquiries regarding the same offshore income during 3-year period. However, the company must still file an offshore claim each year.

Advance Ruling – Process & Fees

Seeking Advance Ruling for offshore profits claim in Hong Kong

Advance Ruling allows companies to receive advance confirmation from the Hong Kong tax authorities on whether a specific income transaction would be taxed in Hong Kong. This is a useful process for multinational companies that need clarity while tax planning. Companies submit detailed information on specific transactions and the Hong Kong IRD will issue a written response on whether they will tax this income or not. However, advance rulings can be a costly process.

The Advance Ruling Process for offshore profits claims

To apply for an advance ruling, a company must submit a written application along with the following supporting documentation:

- Detailed information and supporting documents about the specific proposed arrangement or transaction.

- Information about the parties involved, the relationship between the parties, the commercial and financial details of the parties

The Advance Ruling Fees for offshore profits claims

The application fee for offshore profits claims advanced ruling is HK$45000, however, this fee only covers up to 23 hours of work by any Hong Kong IRD staff. Complex transactions or insufficient information provided causing IRD staff to use more than the allotted 23 hours will incur hourly fees from HK$1730 to HK$2650 per hour.

Yau and Wong CPA’s offshore profits claim services and how much we charge

Most companies filing an offshore claim prefer to use a CPA. Yau and Wong CPA has a wealth of experience, and our offshore profits claim fees start from US$250. If you’re looking to expand your business to Hong Kong, we’ll get you set up with a business certificate quickly. Get in touch with us today!

Conclusion

The Hong Kong profits tax offshore claim provides a valuable tax exemption for companies that can demonstrate their profits were earned outside of Hong Kong. However, the process of making an offshore profits claim can be complex and often requires quite a bit of expertise in tax regulation. Companies making an offshore profits claim will need to be diligent in their record keeping to provide detailed information supporting their claim.