If you’re reading this, you probably just received mail from the government labeled “Employers’ Return of Remuneration and Pensions” (Form BIR56A), and you may be feeling lost and overwhelmed. Don’t worry though, in this article, we’ll go over what forms you’ve got in your hands, what information you need to fill them out, and other important info you won’t want to miss.

What are the BIR56A and IR56B forms?

The Employer’s Return is a group of forms that report annually to the Inland Revenue Department (IRD) the amounts of remuneration and benefits received by each employee of a business. All registered companies in Hong Kong are by law required to submit the BIR56A and its supplementary forms.

Why did I get the Employer’s Return now?

If you are a new company, you will typically receive the Employer’s Return letter 3-6 months after the company has filed its first audit.

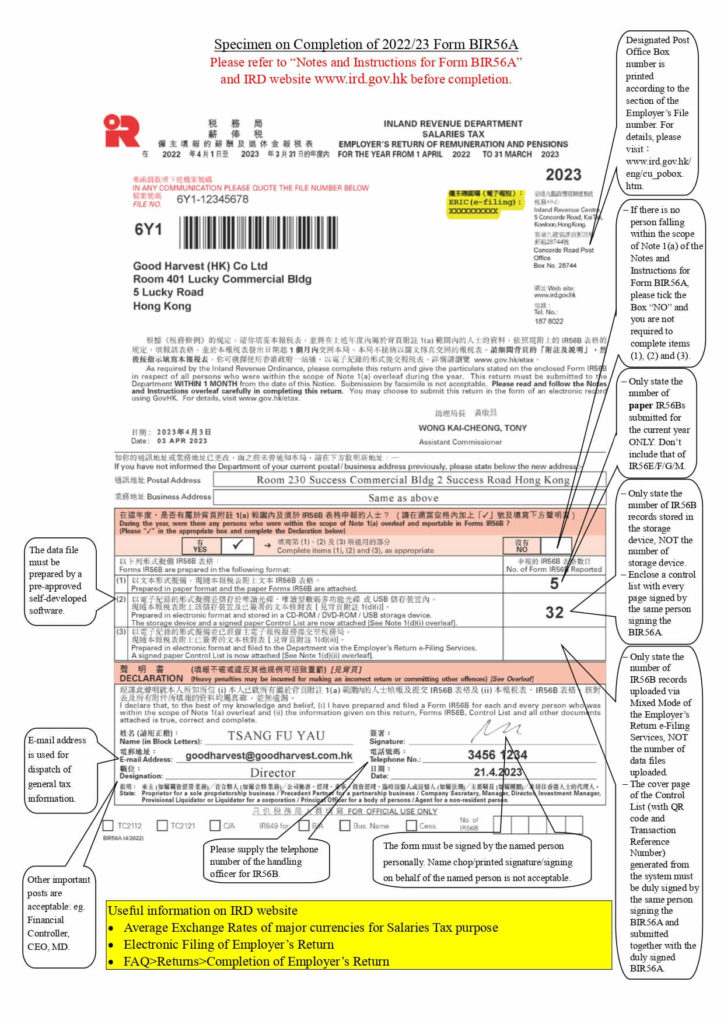

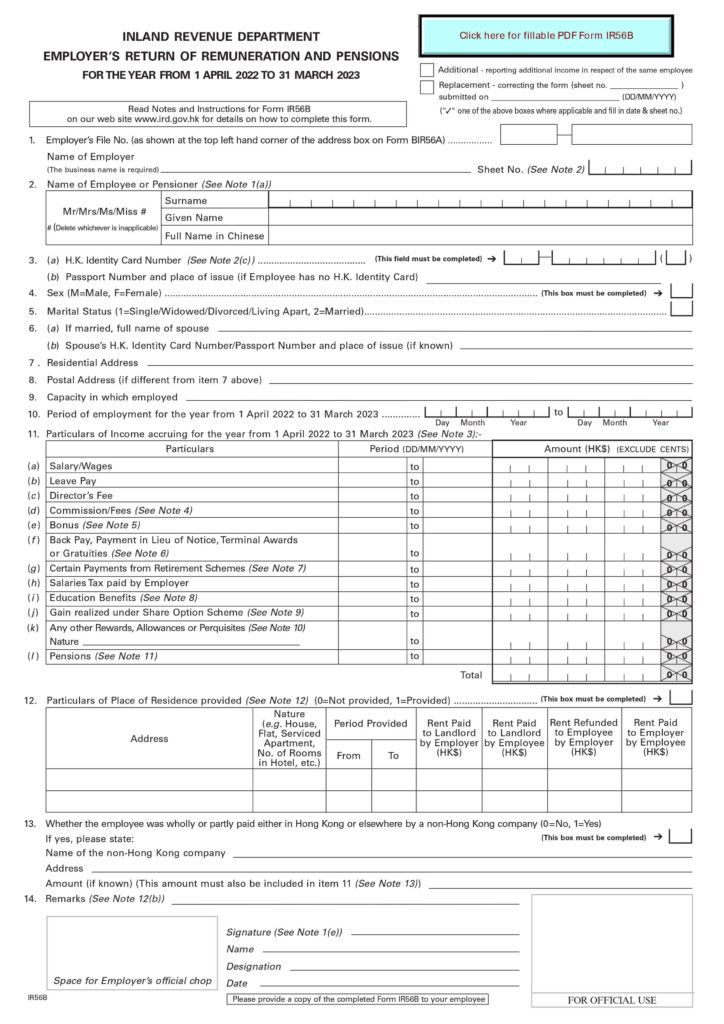

Sample Forms

When do I need to submit the Employer’s Return?

IRD typically issues Employer’s Return forms on the first working day of April each year, which must be completed and submitted within one month of the date of issue, usually printed on the mailed form.

Can I file for an extension?

If you need more time to prepare your Employer’s Return, you can file for an extension with the IRD. You must present your request in written form and include:

- Company’s file number;

- Company name;

- The year of assessment in question;

- The additional time you need and,

- Why you are applying for an extension, with supporting evidence.

What happens if I miss the submission deadline without an approved extension?

If you fail to submit the Employer’s Return on time, you may be fined starting from HKD1,200 and given a new submission deadline by the court. Continue missing deadlines and you will continually be fined up to a maximum of HKD10,000 and given a new submission deadline by the court.

Who fills out the form, and who needs a form filled out?

Employers are required to collect their employee’s details as required by the form and fill them out accordingly, finalized by the employee’s signature confirming the details as true and accurate. Employees are required to be included in the employer’s return if they are:

- Single and paid an annual income of HKD $132,000 or more;

- Married (regardless of income);

- A part-time staff (regardless of income);

- A director (regardless of income)

Employees should be provided copies of their IR56B forms to make sure that the salary amount reported on their personal tax income is the same as the amount recorded on the Employer’s Return.

If I don’t have any employees, do I still need to fill out form BIR56A?

Yes you do still need to fill out the form BIR56A, but you will check the box in the pink section instead, declaring that you do not have any employees. As an employee of your own company, you will still need to fill out your own IR56B form.

Special Cases

You may have special cases of employees that aren’t full-time or geographically local. The following table shows the types of employee status’ and the corresponding form they’ll substitute in place of form IR56B if applicable.

| Employee Type/Status | Form Required | Additional Info |

| Part-time | IR56B | |

| Freelancers | IR56M | |

| Overseas Full-time / Part-time | IR56B | Under item 14, provide additional information, E.g. the employee worked in the Singapore office and visited Hong Kong for a total of fewer than 60 days during the entire year of assessment |

| New Hires | IR56E | |

| Terminated Employees | IR56F | Must be filled in and submitted one month before the date of termination or upon death |

| Leaving indefinitely | IR56G | File 2 copies or online one month before the expected date of departure* |

*Procedures for Employees Leaving Indefinitely

An employee that wants to leave Hong Kong for an indefinite amount of time needs to first clear his tax duties before his employer can release the remaining amounts owed to him (including salaries, commissions, etc). Once the employee’s departure date has been established:

- The employer needs to file one copy of a completed IR56G form one month before the employee’s departure date, and give the other completed copy to the employee.

- The employee then needs to clear his taxes with the IRD. Once his taxes are paid, he needs to bring a receipt of payment to the IRD’s Collection Office at 7/F Revenue Tower to request for a “letter of release”. Assuming everything is in order, the IRD should take 30-40 minutes to generate the letter to pass to the employee.

- The employee must then produce the letter of release to his employer, who can then release the owed amounts to the employee.

What information do I need to fill in the Employer’s Return forms?

As an employer, you are required to start payroll records for all employees of your company, including yourself, and keep them for at least 7 years rolling and notify the IRD as soon as possible if there are any changes. Payroll records include the following information:

Profile Information

- Personal particulars: Name, address, HKID or passport number with place of issue, marital status;

- Nature of employment: Full-time or part-time;

- Job title: e.g. director, CEO, regional manager, accountant, marketing associate;

- Amount of salary paid: In domestic and foreign currency where applicable, and any salary given outside Hong Kong

- Non-cash or additional benefits: e.g. housing or accommodation, vacation allowances, stock awards and share options

- Employer’s and employee’s contributions to the Mandatory Provident Fund (MPF) or its equivalent

- Employment contract and amendments to the terms of employment

- Period of employment

Remuneration Package (Chargeable income)

This consists of pay and benefits provided to the employee that needs to be recorded in form IR56B, including:

- Salaries, Wages and Director’s fees;

- Commissions, Bonuses, Leave Pay, End of Contract Gratuities and Payments In Lieu of Notice accrued on or after 1 April of the current year;

- Allowances, Perquisites (Benefits received because of your job position) and Fringe (Additional) Benefits -including holiday benefits;

- Tips received;

- Salaries Tax Paid by Employer;

- Value of a Place of Residence provided by the employer;

- Stock Awards and Share Options;

- Back Pay, Gratuities, Deferred Pay and Payment of Arrears;

- Termination Payments and Retirement Benefits;

- Pensions.

How do I fill in the forms?

You may fill in either hard copies of the BIR56A and IR56B mailed by IRD (or request a new form from the IRD’s website) and mail them back filled, or use the online Employer’s Return e-Filing Services, which includes two methods, an online mode and a mixed mode.

Online

The online mode is fully digital, and requires the Authorized Signer (e.g. Sole proprietor, precedent partner, director, etc.) to create an account on the IRD’s eTax service to sign and submit the Employer’s Return.

Once on the eTax service, you can choose to enter your employees’ details directly (max 30 IR56B forms per session), or upload a data file (max 800 IR56B forms per data file).

Tip: As a new business owner, you will likely have few employees, making the online direct input method the most efficient way to submit the Employer’s Return.

Mixed

This mode allows anyone appointed by the employer to submit BIR56A, IR56B or its substitute forms online without needing to log in to the eTax service. When the forms are uploaded to the system, a Control List paper (with a Transaction Reference Number and QR code) will be generated from the system. The Authorized Signer will then need to sign and submit the Control List paper to the IRD to complete the process.

I need help filling out the forms

Still confused? We offer Employer’s Return filing services with our accounting / audit package. Talk to us today to see how we can help you!